A beginners guide, part 1 in a 2 part series.

Chapter 1.

What does decentralised finance (DeFi) even mean?

Good question, It’s the idea that anyone can access financial services be it earning interest on deposits, investing in markets or even borrowing money. So even if you don’t have a bank account you can still have access to all of these services and have the opportunity to take part in financial markets.

Why do we need this in the world?

1.4 Billion people in the world don’t have a bank account, there are many reasons for this regulatory, banking infrastructure etc… DeFi allows anyone with an internet connection to be able to do financial transactions anywhere in the world without any restrictions from a government, corporation or any organisation that seeks to impose an authority over your financial freedom.

How can all of this be possible?

For the first time this has become possible because of the technological advancements made in blockchain technology over the last ten years.

The inherent nature of a blockchain fits perfectly for the application of DeFi, in that it whatever is stored on a blockchain cannot be edited or overwritten by anyone. Every single transaction between individuals on the blockchain will be there forever and is persistent, so there can be no question whether a transaction did actually happen. This fact fits perfectly with the whole blockchain mantra “Don’t trust, verify” as someone using blockchain technology you don’t need to trust or go on good faith of someone you are transacting with, you can verify everything on the blockchain.

In the case of your TradFi (Traditional Finance) bank account, how do you actually know that they have all your money there? You don’t. You trust your bank that they won’t recklessly use your money so that when you want to withdraw your funds the money is actually there.

Time after time has shown, the facts are there that the banksters are not to be trusted.

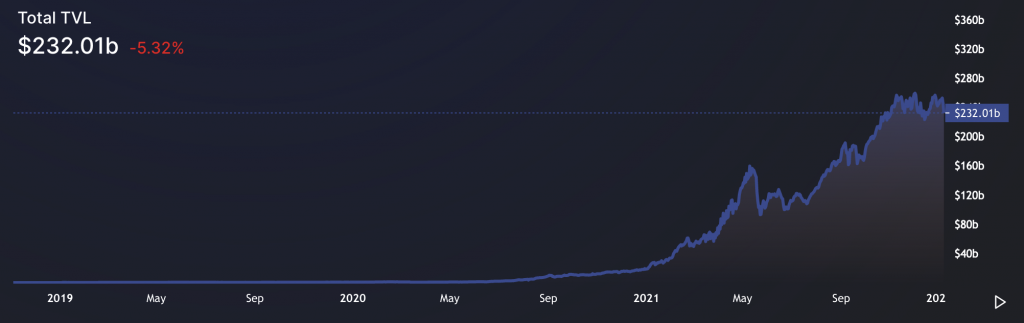

The need is clearly there and uptake in the DeFi space has been insane over the last one and a half years. The TVL (Total Value Locked, the amount of money deposited in DeFi apps) has rocketed to over $230 billion and has no sign of slowing down.

see https://defillama.com/ for updated stats on TVL.

Components of DeFi

DeFi today is built on top of many different blockchains, the one we will be using in this guide is called the Ethereum blockchain. The Ethereum blockchain can be thought of as the operating system just like Android and iOS are operating systems for smart phones. It provides the networking, security and storage (very little) for applications build on top.

Where the action happens is in the applications and this is where our focus will be.

Chapter 2.

What do I need to get started?

This guide assumes you have a computer with an internet connection and the Chrome web browser already installed.

Metamask

Since we will be using the Ethereum blockchain, we will need an Ethereum compatible wallet. The most popular one out there is called Metamask, it’s an extension that works with the Chrome web browser and is used to interact with web3 applications such as meta verse games, NFT marketplaces and of course DeFi apps. Metamask holds the public and private keys to your wallet and with those keys are used to sign the transactions needed to interact with web3 applications.

See here how to install Metamask

Mnemonic key storage

An extremely important point when working with Metamask is that when generating a new wallet address, you should store the 24 word seed phrase in a very secure location. The seed phrase should;

- Never be stored on your computer or phone.

- Never take a photo of it.

- Be stored in a safe or other location with limited access.

- Create at least a second backup and store that in a different secure location.

- If it’s written down on a page, use a pen with permanent ink that will not fade over time.

If you lose access to your Metamask wallet by uninstalling Chrome, factory resetting your computer or your hard drive crashes. You can use the seed phrase to recover your wallet, if those events occur and you do not have access to the seed phrase there is absolutely no way for you to recover your wallet and any funds stored on it. The funds will be unrecoverable forever.

As you can see it takes quite a lot of responsibility on the part of the user of this technology, especially when dealing with large amounts of funds, hopefully in future as the technology matures even further this will not be such an important factor.

Chapter 3.

Apps

Uniswap v3

Uniswap is by far my most favourite DeFi app, it’s what you called an automated market maker (AMM) basically what it does is allow users to do swaps between different crypto coins. Almost like an exchange, except that it doesn’t use order books but using something called Liquidity pools.

Liquidity pools

This is my most favourite feature in Uniswap, Liquidity pools work by having a “pool” of coins for each trading pair and it’s from this pool that when you swap the coins are taken from.

For example: In the trading pair USDC-ETH, there will be equal value of each side of the trading pair in the pool, if we take ETH price to be $4000, and we have 2 ETH in the pool we must also have an equal amount of USDC. So 2 ETH multiplied by $4000 will give us $8000 i.e 8000 USDC coins. So the total $ amount in the pool would be 2 ETH + 8000 USDC = $ 16000.

When using Uniswap to swap, you pay a fee of 0.3% this fee is then given to the users who have contributed Liquidity (ETH and USDC in our example above) to the pool, the 0.3% fee is split amongst all the contributors in proportion to the amount of Liquidity they have provided.

For a more in depth explanation of how Uniswap works see this link from Binance academy

You can try out the app yourself at https://uniswap.org/

Aave

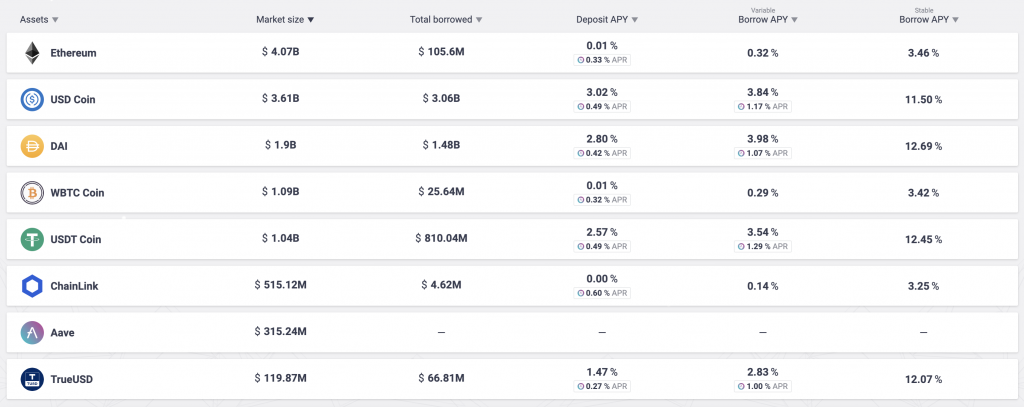

Another top DeFi application is Aave, Aave is a money market, it allows users to deposit coins and earn interest on those deposits while also allowing users to take out collateralised loans of certain coins. By taking out loans from those who have deposited, you will pay a variable interest rate that goes to all those users who have deposited coins. You can see the different rates below.

You can try out the app yourself at https://aave.com/

and that’s a wrap for part 1, part 2 will be coming soon. Hope you learnt something from this post and are keen to get started in the space.✌️